Thinking Fast and Slow about Management Lessons

For this week's post, I'll revisit a much-celebrated book, Thinking Fast and Slow by the "grandfather of behavioural economics" Daniel Kahneman. However, it's not a book review but more a series of 7 valuable lessons that can help navigate both life and corporate life a little better:

Lesson 1: Good leaders facilitate cognitive ease

‘Just ask’ is an easy enough corporate ground rule in theory but a different ball game in practice. Employees hesitate to ask questions for fear of rebuke or ridicule. This is why it’s so important to create an atmosphere of trust and familiarity, where new concepts and theories can gain currency through repetition, primed association, and clarity. Cognitive ease and strain have interchangeable effects. While one leads to general bonhomie with ideas feeling effortless and true, the other is indicative of how many Londoners feel when you accidentally make eye contact with them on the tube.

Lesson 2: Cognitive load weakens self-control and leads to selfish choices

Taking work home or being inattentive/impatient with the ones who matter is a poor way to balance life. Bad days at work will come and go, but learning to disconnect from the mental noise, working on self-control, and responding rather than reacting will serve you in the long run.

Lesson 3: You can choose to stay calm and carry on in any situation

Our brains have reciprocal links in the associate network, where the priming effect works wonders. If you can act calm and considerate irrespective of the situation you are in or how you feel, you will likely be rewarded by actually feeling calm and considerate.

Similarly, since intense focusing on a task can effectively make people blind to the obvious and to their own blindness, if you see only the negative in a situation, providence will take a long walk and even the opportunities in plain sight will elude you.

Lesson 4: Give more credit to your psychological immune system

Take that risk. Make that point. Fear of regret, even if self-fulfilling, will hurt a lot less than what you anticipate thanks to the efficacy of your inbuilt psychological defenses. Winnie-the-Pooh was not kidding when he said that you are stronger than you seem and less risk-averse than you believe.

Lesson 5: Sunk cost fallacy is more common and letting go more difficult than you think

Sunk cost fallacy keeps people in poor jobs, unhappy work relationships, and unpromising projects. It also explains the disposition effect (due to narrow framing) and sunk cost errors in stock trading, where you want to close every account as a gain, irrespective of its future potential (like selling the stocks likely to increase further in value or holding on to the ones that are duds). Businesses competing with superior technology often cannot cut losses because it's hard to give up, even if it's the right thing to do.

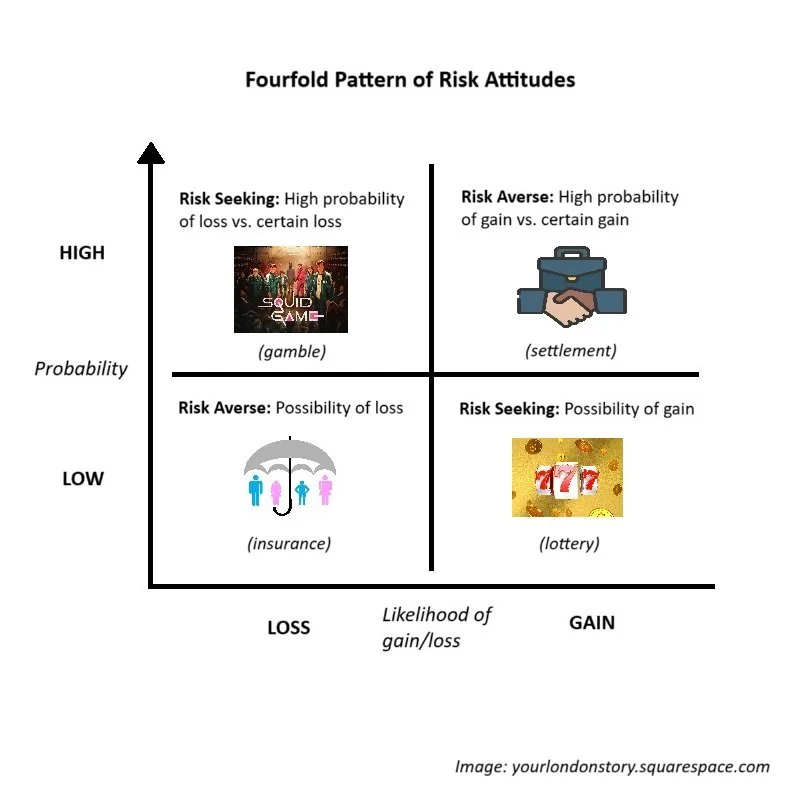

Lesson 6: Squid Game is part of the Fourfold Pattern of Risk Undertaking

When faced with terrible options, where a sure loss is compared to a larger loss that is probable, diminishing sensitivity causes people to take more risk. When there is sure gain, people take less risk. In mixed gambles, where both gain and loss are possible, loss aversion causes risk-averse choices, and the possibility of gain risk-seeking. These are part of Prospect Theory's Fourfold Pattern of Risk Attitudes demonstrated in the figure below.

Speaking of risks, did you know that the brain responds even to purely symbolic threats and negative, evocative words? So err on the side of optimism, and look out for glimmers instead of triggers for a more regulated nervous system.

Lesson 7: Intuition adds value only after a disciplined collection of objective information and scoring of separate traits.

Contrary to popular belief, intuitive/subjective judgement can be trusted when two simple conditions are met - the environment is sufficiently regular to be predictable, and there is an opportunity to learn these regularities through prolonged practice. An excellent example of this is a medical professional who, after decades of practice, can instantly recognise signs and patterns of oncoming illnesses in patients.

Remember, "intelligence is not only the ability to reason, but also the ability to find relevant material in memory and deploy attention when needed". Let the law of least effort not take over. Exercise deliberate checking and search wherever possible (characteristic of System 2 thinking), even when the easier option is to go with an intuitive but possibly incorrect answer.

“For the great enemy of the truth is very often not the lie - deliberate, contrived and dishonest - but the myth - persistent, persuasive and unrealistic. Too often we hold fast to the clichés of our forebears. We subject all facts to a prefabricated set of interpretations. We enjoy the comfort of opinion without the discomfort of thought.”